Learn how to stake Cardano ADA and get the rewards, how Cardano staking works, and how much you can earn.

What is Cardano staking?

Holders of Cardano native cryptocurrency ADA (₳) are rewarded additional ADA by taking part in the network consensus.

Cardano staking stands for delegating your ADA (₳) to a stake pool and earning additional ADA as a reward proportional to your stake and the pool’s overall ability to produce blocks in that Epoch and some other parameters.

Cardano blockchain continuously grows, and new blocks are created every 20 seconds. Blocks are grouped in Epochs, which are 5 days long.

What are Cardano stake pools?

Stake pools are nodes on the Cardano network, run by reliable operators: individuals or businesses with the knowledge and resources to run the node that is set up to perform the essential functions of staking and creating blocks for the blockchain.

Cardano stake pool saturation point

The Cardano stake pool will reach the point of saturation when its total amount of stake or % of total live stake in the network becomes too big. When it happens, the stake pool starts receiving fewer block assignments from the network and, proportionally — fewer rewards.

Why does it make sense? To have a fully safe decentralized blockchain network that can’t be compromised, you can’t allow any participant (stake pool) to have, let’s say, 30% of a total network stake or a “vote” in the system.

Why does Cardano encourage and reward staking?

First and foremost, the overall objective of staking is to provide security to the network of transactions. The more staking pools is online and producing blocks, the more secure the network becomes.

Rewards incentivize ADA holders to participate in the network protocol of producing and validating blocks.

How much can you earn staking ADA?

The total amount of stake delegated to the stake pool and the pool’s pledge are the primary way the Cardano protocol called Ouroboros chooses which pool should add the next block to the blockchain and get a reward for doing so.

The more stake is delegated to a stake pool (up to a certain point of saturation), the more likely it is to make the next block — and then the rewards are shared between the stake pool operator fixed fee and everyone who delegated their stake to that stake pool proportional to their investment — but also according to stake pool operator reward percentage they set by themselves, at anywhere from <1% to 100%!

The current average APY (annual percentage yield) or the ADA rewards per year you get on your staked ADA is around 4,5% among most pools.

The difference between APY and APR is that APY includes “compounding”. The ADA rewards you get after each epoch are automatically added to your stake!

You can check out the Cardano staking calculator on the official Cardano website.

The amount of rewards (ADA) the stake pool and it’s delegates get depends on factors with the already mentioned amount of stake delegated to the stake pool and stake pool operator rewards % set for its delegates: the stake pool operator’s pledge, the number of blocks the stake pool has successfully validated/produced and the fixed pool fee.

The stake pool fee is a % of the total ADA rewards pool made in that Epoch paid to a pool operator. It’s used to keep the stake pool operable and optimized to receive rewards in full after all dedicated blocks are successfully minted.

How to stake Cardano ADA?

You can stake ADA on cryptocurrency exchanges like Binance or using the Cardano native wallet or multicurrency wallet.

Stake Cardano ADA on the exchanges – Bad Option!

Staking on exchanges can be viewed as similar to investing in fixed-income securities, such as bonds or money market funds. The exchanges are doing the staking process on your behalf.

But there’s an old saying: “Not your keys, not your coins”. The exchanges are in control of both of your wallet keys: the private key and the public key. You are just using their services; you do not really own your account, and they can shut it down whenever they want. You can also not vote on the Cardano proposals or – be part of the Cardano blockchain governance and other features.

Stake Cardano ADA using the Safe Wallet – Good Option!

When you create any wallet, you get a set of keys – the private key and the public key. The private key is used to sign the transactions and, as a digital signature, proves your ownership over the coins on the blockchain. The recovery phrase you get is the form of the private key. You write it down and keep it safe because if you lose it, you lose the ownership over your coins, in this case, ADA.

There are many desktop, browser extensions, mobile, and hardware wallets you can use to easily stake your Cardano ADA by just choosing between the list of the best-performing stake pools. They also allow you to manage Cardano tokens – native assets and Cardano NFTs, and connect and use Cardano DApps like DEXs, NFT marketplaces, and games.

The safest way to manage and stake ADA is by using the hardware wallet, a physical device that secures your private key in the safe chip, and all transactions are signed internally. You can connect them to as many Cardano software wallets as you wish and use their functions. They are only provided with your hardware wallet Cardano public key which generates the public addresses, they never get in touch with your private key.

CadaNews has the best article to learn about and choose the best Cardano wallet. It is the biggest list compiled of the fully working 7 Cardano wallets you can use to manage and stake Cardano ADA safely.

When staking, your ADA stays in your wallet, and nobody can access it (not even stake pool operators).

You get rewards after each Epoch (5 days). The rewards are paid out to your wallet.

Your staked ADA never leaves your possession. It’s not locked up, you are free to un-delegate, spend and send your ADA at any time.

You can re-delegate your ADA to a new stake pool if you are not happy with the performance of the current one.

What is the Best and Safest Way To Stake Cardano (ADA)?

The best and safest way to stake ADA is to use the Ledger Live safe environment. You can use any of the Ledger hardware wallets. We highly recommend Ledger Nano X for its affordability and top-notch security. You can also use the budget-friendly Ledger Nano S Plus or the innovative Ledger Stax.

Step 1: Buy Ledger Nano X and set it up using Ledger Live.

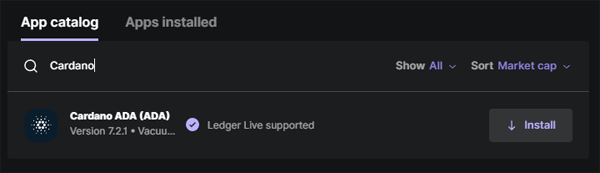

Step 2: In Ledger Live, install the Cardano app from the App catalog.

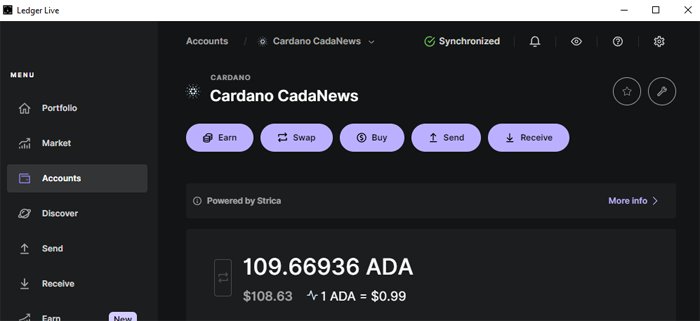

Step 3: Click the Accounts tab and add the Cardano account.

You can now send ADA to your wallet address or buy it using the Ledger Live safe environment.

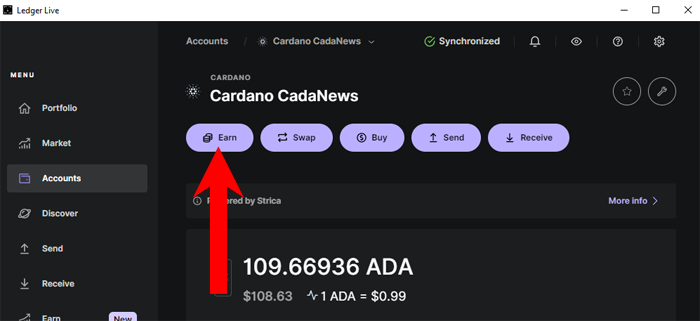

Step 4: Click on the Earn tab.

Step 5: Choose a stake pool with a high total ADA stake, as Cardano’s consensus protocol, Ouroboros, favors stake pools with larger ADA stakes when minting blocks, which means higher rewards.

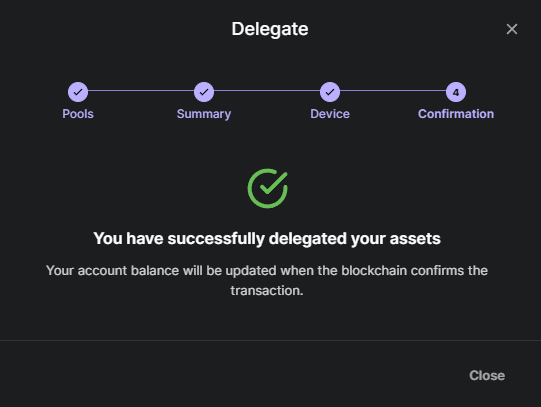

Step 6. Click Continue and confirm the delegation on your Ledger hardware wallet.

Step 7. Done. You will now start receiving rewards in ADA every epoch (5 days)!